Lab Seminar - Tax avoidance of vehicle registration in Mexico City

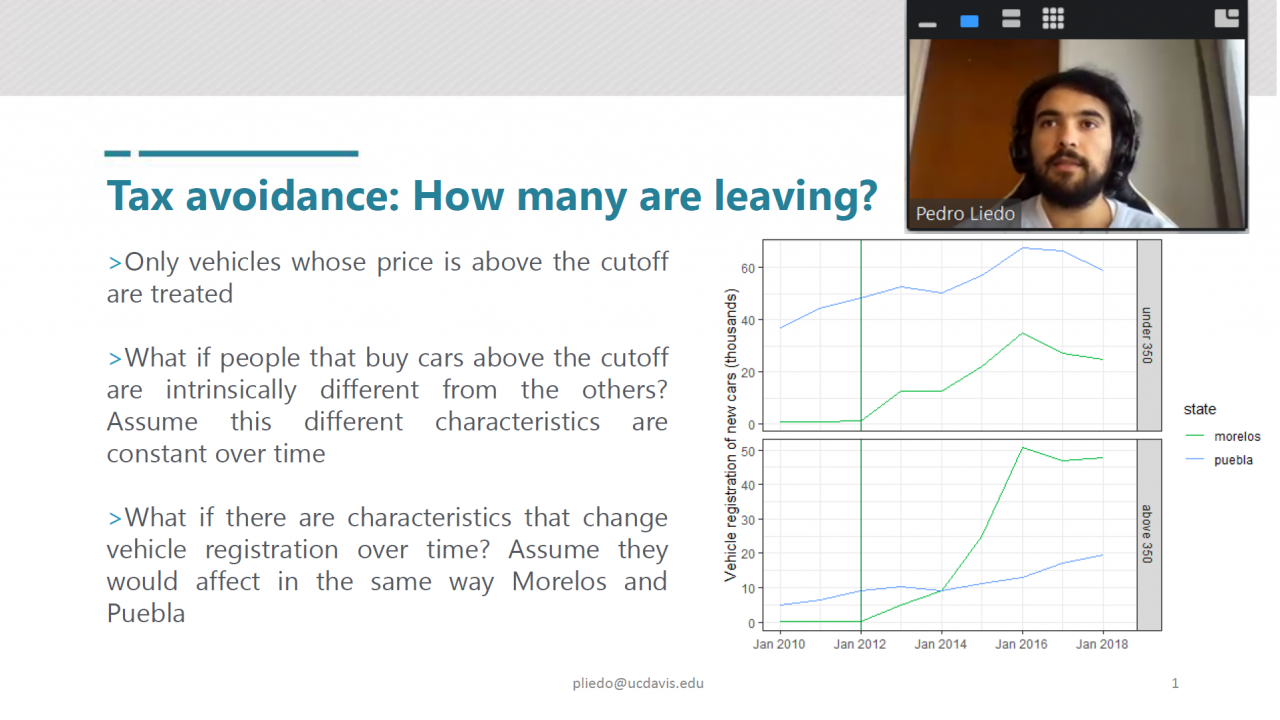

Pedro Liedo Orozco presented his work about environmental tax evasion. Environmental taxation is used to correct externalities and collect revenue. However, when agents game the system the results are different from what expected. Using a triple difference in difference approach on a rich tax differential setting across price ranges and states in Mexico, Pedro was able to estimate the lost revenue and the impact of a tax on vehicle registration on the total number of vehicles on such states. Pedro showed that when local governments offer different tax schedule, most vehicles are registered on those states with the lowest rate, affecting the overall revenue collected as well as the aggregated number of vehicles registered. Finally he described some alternatives to tackle evasion.